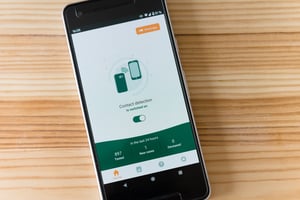

As the number of COVID-19 infections increases globally, some countries have turned to tracing...

College is Not For Everyone: Other Options Exist For a Lucrative and Fulfilling Career

Leonardo Da Vinci wasn’t born one of the greatest artists in history. His transcendent skills as a painter, sculptor, and inventor were acquired through decades of focused hard work and practice. What most people don’t know is that as a young boy, he began his career as an apprentice. Apprenticeships have a proud history dating back more than 4,000 years and are still in use today.

Though apprenticeships still exist today, parents and teachers in the post WWII era have been “pushing” kids to go to college as a SURE-FIRE WAY of being qualified for a “good” job. The “push” seems to have worked. In 2017, 34.6% of women, and 33.7% of men, had college degrees in the U.S. But, before parents and teachers get kids aboard the “college bound train,” they should consider several potential downsides to the college option.

Rising College Tuition and the Debt Trap.

Since 1987, the average tuition at a four-year public institution in the U.S. has risen from $3190 to $9970 – a 213% increase, and at a private four-year institution from $15,160 to $34,740 – a 129% increase. At the current rate of increase (an average of 6.5% per year for the last 10 years), the annual average public school tuition will be $44,047 and private school tuition over $205,000 in 2030. Student debt will follow suit with an estimated $17 trillion in outstanding loans by 2030.

Of course, most students cannot afford college without loans. In fact, 70% of all college graduates today have borrowed to go to. A recent article about the “student loan crisis” in Forbes, noted that the current collective student loan debt from the estimated 44 million borrowers in the U.S. amounts to $1.52 trillion. The average student loan debt in 2017 was $39,400, up 6% from the previous year.

The “student debt problem” is compounded by those who extend their stay at college, or who never finish. Three of 10 high school grads who go to four-year public universities, and 1 out of 5 at private schools, haven't earned degrees within six years (NPR, 2018). Nearly 30% of college students who take out loans drop out, and this group of “debtors without degrees” are four times more likely to default on loans than those who finish.

The Declining Value of a College Degree.

Labeled the “degree premium” in the 1980s, the gap in earnings between someone with a high school diploma and someone with a college degree has become the standard “hook” colleges and universities use to encourage applications for admission. While that gap grew steadily in the 1980s mostly due to the loss of manufacturing jobs in the U.S., its growth began to slow in the 1990s and, since 2010, the gap has remained stagnant.

There has been a shift away from middle-skilled occupations due to automation technologies and a lower demand for advanced cognitive skills also attributable to technology. The declining need for people with a college education has led one expert at the National Bureau of Economic Research to conclude, “Although higher education may be financially advantageous on average, the flattening of returns as costs have continued to rise suggests that college may be an unfavorable financial investment for rising numbers of individuals.”

Poll numbers indicate that many people concur with the declining value of a degree. In a 2017 poll by the Wall Street Journal, 49% of respondents believed earning a four-year degree will lead to a good job with higher lifetime earnings, compared to 47% who did not.

Adding to the trend is the emerging use of platforms like HireArt, where job applicants can demonstrate skills and aptitudes by uploading evaluative work samples, peer and manager reviews, and other credentials for employers. Some of these platforms even allow applicants to compete in work challenges for job openings. Degrees and GPAs are taking second chair to practical application.

Job-Related Health Concerns. Research has correlated long periods of sitting with increased blood pressure, high blood sugar, excess body fat around the waist and high cholesterol. Too much/prolonged sitting can increase the risk of death from cardiovascular disease and cancer. Thirteen recent studies found that more than eight hours a day with no physical activity posed similar risks of dying as do obesity and smoking. The ominous implications here are that “sitting is the new smoking” and “your job may be killing you.”

Another global health threat is digiphrenia. This term refers to the constant bombardment of digital distractions that tend to take focus off what is actually immediately before us, reducing the quality of our encounters such as when friends are absorbed with texting at dinner, or a person is texting while driving. Digiphrenia creates pressure for people to be constantly connected and engaged.

The results can be anxiety, sleep deprivation, decreased productivity and performance at work, and lack of focus resulting from constant distractions. Ultimately, digiphrenia can impact personal relationships negatively and literally kill someone who is distracted while driving, crossing a street, or engaging in other activities that require focus.

Nomophobia is also becoming an epidemic. This condition results from an irrational fear of being without a cell phone. A government study found that 53% of mobile users felt anxious when they were unable to use their mobile phones, and over half of users never shut them off. Another study found that 3 of 5 cell phone users in the U.S. cannot go 60 minutes without using their cell phones (Leonard, 2015). This addiction is real, and several side effects have been documented including, back problems from hunching over a phone, neuralgia, anxiety, depression, disrupted sleep, diminished attention span, cramped fingers, wrist pain, and retinal damage, among others.

Given the sedentary nature of most office jobs, along with expectations of “multi-tasking” and being “connected” 24 x 7 that are common in white-collar working environments, “healthy,” less sedentary alternative careers like those in the trades are appealing to Millennials and Generation Z whose focus tends to be on work-life balance and healthy lifestyles. After decades of preaching college at the best or only option for a good job, the U.S. has a shortage of skilled tradespeople. There are an estimated 30 million jobs in the U.S. paying at least $55,000 per year that do not require a bachelor’s degree.

The are many upsides to careers in the trades.

Wages for Tradespeople are on the Rise. Several factors are contributing to the increase in wages for workers in the trades. Among them are the boom in construction, more and better safety regulations, fewer “do-it-yourselfers,” and the impending retirement of 40% of the current trade workforce in the next 10 years. For the last four quarters, wage growth in installation/maintenance, construction, production, service occupations, and transportation/material moving has been higher than wage growth in all white-collar sectors (Levanon, 2018). In contrast, wages lagged in several prominent college-graduate careers, with year-over-year decreases for network engineers, loan officers, web designers, data scientists and professors, among others.

Job Opportunities for Tradespeople are on the Rise. By 1999, over 75% of the U.S. population worked in the service industry, mostly in offices. The labor pool in the trades had declined to 19% . During the same period, the need for skilled labor increased and continues to do so.

Based on historic trends, Tradesmen International has projected steady job growth in various trades through 2024:

Construction Laborers 1,159,100 1,306,500 12.7

Helpers-Electricians 69,000 81,500 18

Pipe layers 45,700 51,000 11.4

Millwrights 40,900 47,100 15.2

Helpers-Carpenters 39,700 42,700 7.5

Solar Photovoltaic Installers 5,900 7,400 24.3

Of the 30 occupations projected to be the fastest growing through 2024, 19 are in the trades.

And many trade jobs, especially in manufacturing, pay well above the national average without a college degree. (Occupation descriptions from the Bureau of Labor Statistics’ Occupational Employment Statistics. Wages from CareerBuilder)

Machine Tool Programmers: Median hour wage: $41

Welding, soldering and brazing machine setters, operators and tenders: Median hourly wage $22

Tool and Die Makers: Median hour wage: $26

Industrial Machinery Mechanics: Median hour wage: $23

Machinists: Median hour wage: $21

Moreover, most trade jobs are immune to automation/artificial intelligence. Robots lack the manual dexterity and motor control to compete with humans. Skilled tradespeople have to perform a variety of physical tasks that are situational and based on previous experiences. AI and robotics, while enabling data-based decisions and repetitive mechanical motions in a controlled environment, lack the flexibility of humans (Browning, 2018). Likewise, most trade jobs are immune from offshoring. As one expert noted, “You can’t hammer a nail over the Internet. …”.

Trade Positions Have a “Healthy Side” and Come with Built-In Job Satisfaction. A Gallup poll found that 71% of American workers are either not engaged or actively disengaged from their jobs. In 2012, overall job satisfaction overtook job security as the employee’s most important consideration. An estimated 70% of Americans feel bored and/or dissatisfied at work. In contrast to many office jobs, Tradespeople are busy and usually work with his/her hands all day, leaving little or no time for boredom.

When work is over, it is over, which means a better work-life balance. Emailing, texting and business calls outside of regular working hours are the exception, not the rule. Work in the trades means fixing something, building something, or making something work. There are tangible results and a sense of accomplishment from labor that “feels good.”

Tradespeople don’t spend most of their day in front of a computer (digiphrenia) or on a cell phone (nomophobia). They are mobile and engaged in tasks.

Often, tradespeople become their own bosses and sometimes, as Thomas Stanley and William Danko note in their book, The Millionaire Next Door, do quite well at earning a living (1996).

Trade School Education is Cheaper and Shorter. In 2017, the average cost to attend trade school was $33,000, and the duration of training combined with an apprenticeship for skill trades averages 2 years.

Earn while You Learn. Apprenticeships are structured programs designed to allow the student to gain and apply skills and knowledge on the job, while working towards a certification or credential. Once completed, the student should be able to “hit the ground running” and earn a better salary earlier on in his/her career and with more confidence. Better yet, apprentices earn while they learn.

Less Debt. The average debt load for trade school graduates is only $10,000, less than 1/3 of that for a college graduate. Any initial “gap” in wages between a tradesperson and a college graduate has to be offset by the significantly lower student loan payment for the average trade school graduate, the wages s/he earns during an apprenticeship, and the full-time wages s/he earns upon graduation at least 2 years sooner than a college graduate.

Trade School Education is More Hands-On. Adults learn best when: they understand why something is important to know or do; they have the freedom to learn in their own way; learning is experiential, and the process/experience is positive. A trade school education includes both classroom learning and experiential learning. Students study a subject not as an academic discipline, but as a means to develop skills for practical application in the real world. Trade schools teach people how to learn, making the acquisition of future skills easier – less theory and more practice. Whether the student is a visual, auditory, or tactile learner, trade schools use all of these modalities.

Are there any modern-day Leonardos out there who will take a different path toward learning, job satisfaction, and financial reward?

.jpg?height=200&name=Designatronics_blog_prosthetics%20(1).jpg)